Importing from China

Duty Drawback Software | Import Export Consulting | Processing Filing | Full Service

What is Drawback

Contact us

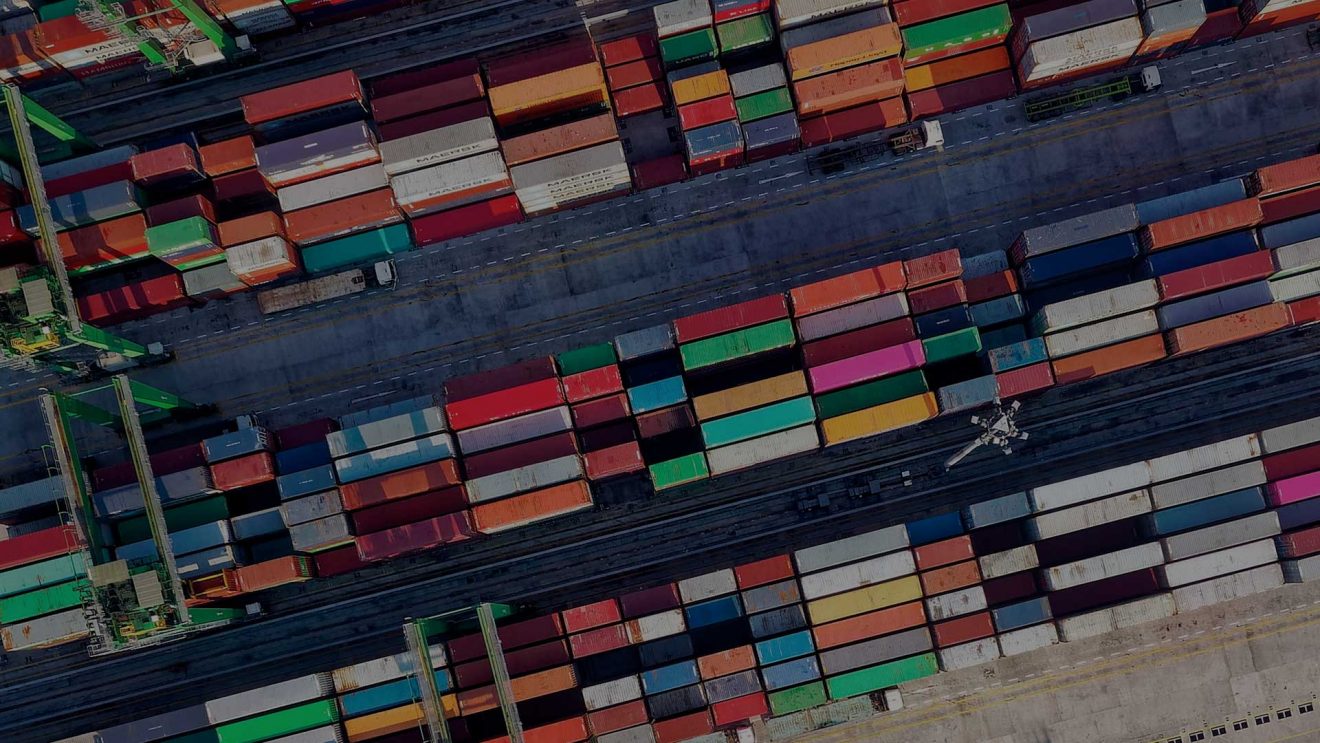

Many companies within the U.S. import goods from China. Last year China’s trade surplus reached $422 billion U.S. dollars. Why? Well, China is a low-cost labor country, their raw materials cost about 1/10th of U.S. raw materials, and the Chinese are simply the best designers. Their vision of product design across industries is second to none. That being said, it is not hard to see why many companies choose to import from China. If you run a company that is looking to import goods from China, well, that is not a bad idea at all. But, you should consider doing a few things.

Define your product’s quality benchmark. In order to do this, you and your team need to work on three design aspects. First work on your ideal design and specifications. Then, finalize the flow of work to be carried out on raw materials. Lastly, decide on a benchmark. Know what your ideal quality standards are and your acceptable levels of flaws.

Next, you need to communicate quality standards to the supplier. Define things like protocols and timing. Communicate in person as much as possible. Form that relationship and do not get comfortable doing business only online.

You should also ensure that your product’s quality criteria is fulfilled by the supplier. In other words, compare what they give you to the benchmark that your company has created. A good way to ensure that your product is up to your standards is to implement pre-production audits, in-progress audits, and post-production audits. In these audits, you can sample test and make sure everything is on track.

Lastly, delegate a responsible authority for conducting those quality control audits. It can be you, it can be someone on your team, it can be a hired on experienced professional, or it can be through a contract with a third party. Whichever option you choose, make sure someone is in charge of checking the quality of your products through audits.

Importing from China can have various benefits but highly consider doing these things when doing business with them. You will be in a much better position to succeed if you follow these suggestions.

For more information on importing and exporting stay updated here on our monthly blog.